In a traditional trust, a corporate trustee is responsible for the trust’s administrative, investment and distribution duties. In a directed trust, those duties are divided: the corporate trustee is typically responsible for the trust’s administration, whereas an adviser is responsible for the investments and, possibly, other traditional trustee duties such as distribution decisions.

Greenleaf Trust has significant experience with traditional and directed trusts, and is available to serve as directed trustee wherever doing so meets our clients’ needs.

Michigan recently added directed trust jurisdiction, thus enabling us to provide this service in Michigan when clients prefer. However, given Delaware’s extensive history with directed trusts, Greenleaf Trust’s directed trust services are generally best executed in collaboration with Greenleaf Trust Delaware.

WHY YOU MIGHT PREFER DELAWARE FOR DIRECTED TRUSTS

Delaware is considered by some to be a national leader because of its history as a trust-friendly jurisdiction. A Delaware directed trust may be created by someone living anywhere in the United States and could potentially afford someone with the following benefits:

Asset Protection

A Delaware trust that contains a spendthrift clause provides its beneficiaries substantial protection from creditor claims. In addition, the trustee may exercise discretion to pay the beneficiary’s ongoing expenses, even if it is aware there is an existing creditor.

Tax Advantages

Delaware provides significant tax savings for trusts created by and benefiting non-Delaware residents. With the trust not subject to state income tax or capital gains tax, this could be a significant tax-savings.

Control and Flexibility

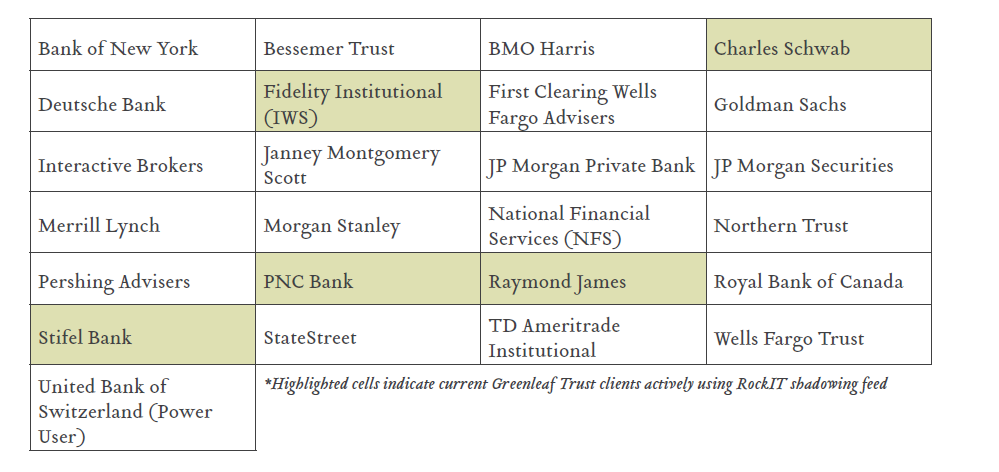

Delaware’s directed statute allows almost all discretionary duties, traditionally the responsibility of the trustee, to be handled by an adviser, which is appointed in the trust or by the grantor, trust protector or committee. Those duties include distributions as well as investments. By appointing a distribution adviser to direct distributions, someone other than the corporate trustee decides when to make distribu-tions to beneficiaries. This may be important to the grantor since they may feel more comfortable appointing an adviser who has extensive and intimate knowledge of each beneficiary’s situation, and may rely on that knowledge when directing distributions in accordance with the terms of the trust. An investment adviser will have the power to direct the trustee for investment management and decisions, decide who manages assets of the trust and whether to hold a concentrated position in the trust. This may be particularly comforting to a grantor who has funded a trust with a closely held business, since there will be less concern with the corporate trustee deciding to sell the business in order to diversify the assets of the trust. The investment adviser can also hire agents to assist with the investment of trust assets. This includes third-party registered agents and/or financial managers. Greenleaf Trust has direct custodian feeds with the following:

The trust protector is a key fiduciary role in the administration of the trust and holds the powers specifically provided within the trust agreement or other instrument. A trust protector may have the following duties: remove or appoint trustee, advisers and other protectors; amend the administrative and technical provisions of trust; change governing law; enter into fee agreements; delegate trustee powers to trust adviser (person or entity).

If you are interested in learning more about directed trusts, please contact a member of your client centric team. We will work with you and your attorney so that your trust fulfills your financial and estate planning goals.

Greenleaf Trust, a wholly owned subsidiary of Greenleaf Financial Holding Company, is a Michigan non-depository trust bank regulated by the Michigan Department of Insurance and Financial Services. Greenleaf Financial Holding Company, a Delaware corporation, is also the sole owner of Greenleaf Trust Delaware, a Delaware limited purpose trust company regulated by the Office of the Delaware State Bank Commissioner. Both Greenleaf Trust and Greenleaf Trust Delaware provide various fiduciary and non-fiduciary services, including trustee, custodial, agency, investment management and other non-depository services, as well as personal trust, retirement plan, and family office services to clients and entities. Greenleaf Financial Holding Company and its subsidiaries do not provide legal, tax or accounting advice. Please consult your legal, tax or accounting advisers to determine how this information may apply to your own situation.